Estimated reading time: 2 minutes

On May 16th I moderated the second panel at the Digital Green Auto Summit 2020 with the urgent topic «Sustainability« with selected European mobility experts.

The focus of the event is on environment-friendly technologies key trends, challenges, and opportunities in Europe, as well as regional impacts and domestic priorities. Industry professionals and policymakers will delve into debates on the next generation of electric vehicles, delivering electric vehicle efficiency, V2G Technology and the vital topic of safety and legislation.

The 1st panel: Electrification moderated by Wulf Schlachter

Two experts from XX and Germany gave their insights on

. An open discussion with all speakers followed.Statement Wulf (hp)

Wulf Schlachter, CEO of DXBe Management

Panelists:

- Martin Lischka (Pininfarina, the head of product managemen)

- Simon Vogt (Founder &Charge)

The first panel started with a discussion on the effects of Covid-19 in the automotive industry. As Martin Lischka from Pininfarina, the head of product management said, “it will be disrupting not only automotive, but the whole future mobility business that we are in“. He also discussed that the product cannot exist without the brand and otherwise, so we should never split these two topics. It is the same with Pininfarina – “We are focusing on sustainability and beautiful design, that is really in our legacy since the beginning in 1930 until today”. Martin Lischka noted that bringing the dreams of its founder Battista ‘Pinin’ Farina, to have a car of his own name, is very important to the company. Today they are proud of their supercar with a potential zero-emission range of over 300 miles. Power and torque equate to 1,900 bhp and 2,300 Nm respectively, meaning the Battista has the potential to accelerate to 62 mph in less than two seconds, faster than a Formula 1 car, and break the 250 mph top speed barrier. Coming back to the trending topic Covid-19. It was emphasized on the fact that owning a vehicle will be a little bit more attractive in the future compared to nowadays, as at the moment everyone is trying to stay safe, thus driving their own vehicle. Finishing up Martin Lischka said that we „want to have a fantastic sustainable approach with luxury brand C02 neutral in a whole set up of a company“.

Next interesting speaker, Simon Vogt, a Founder of the green tech startup &Charge briefly introduces what the company is about and its driving force. “Our first service is to offer free sustainable mobility”, said Simon Vogt. This free service of &Charge can be obtained by doing online shopping and collecting „kilometres & miles“ with every purchase, which are converted to free sustainable mobility. Moreover, an exciting photo challenge was briefly described – their users get rewarded with kilometres for a picture they take from charging stations, as the location of these stations is important. “It goes like crazy! We received more than 20 000 pictures in the last 3 months“, Simon Vogt said.

While discussing and answering questions, Wulf Schlachter, CEO of DXBe Management and moderator of 1st discussion said that “there will be a market consolidation also on OEM side” and it is hard to calculate exactly how much the automotive industry was affected by Covid-19, but it is pretty clear that “OEMs have many cars in their pipeline”, so it is normal that everybody is trying to get back in shape and to be ready when the pandemic is over.

The 2nd panel: Sustainability moderated by Hans-Peter Kleebinder:

Three experts from UK and Germany gave their insights on urging questions regarding sustainability and micro-mobility. An open discussion with all speakers followed.

Panelists:

- Lukas Neckermann (Managing Director, Neckermann Strategic Advisors)

- Michael Fischer (Digital Solutions and Electrification, Honda R&D Europe)

- Wim Ouboter (CEO and Founder, Microlino AG)

Hans-Peters initial food-for-thought statement:

„Micro Mobility will be boosted by Covid-19“ ….. ERGÄNZEN HP

First speaker, Lukas Neckermann, Managing Director of Neckermann Strategic Advisors, leading consultancy in Mobility in Smart Cities. While introducing his book on the mobility revolution, Lukas Neckermann noted that it is like a journey we are on. “These things sounded like an ultimate goal, but it is a journey of lowering the emissions that we have across transportation”. We see that there is the emergence of a new reformed value chain and new industry. We have an ecosystem that supports shared electric autonomous mobility and Lukas Neckermann said “certainly that will take us to a more sustainable future”.

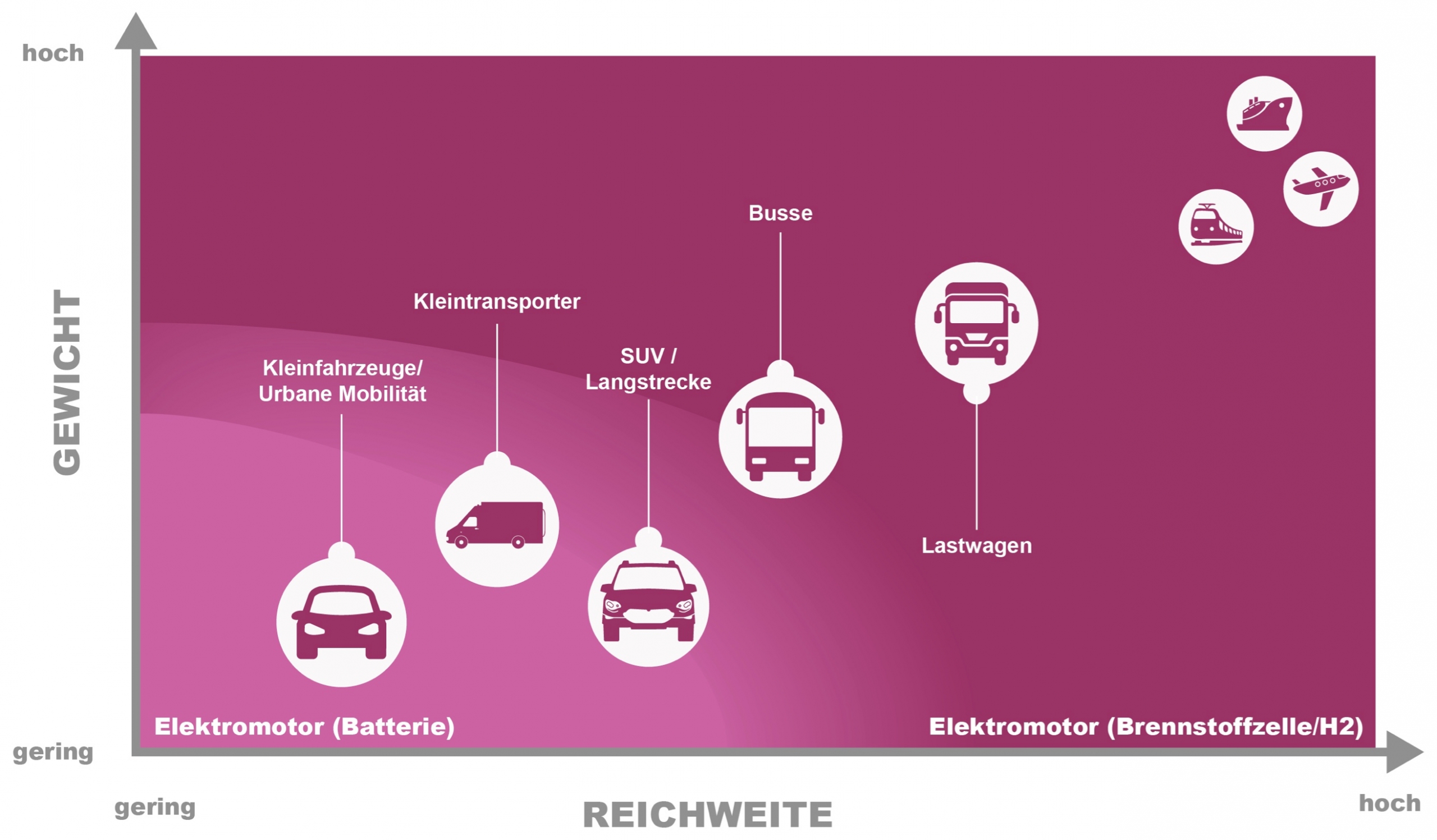

Michael Fischer, responsible for digital solutions and electrification of Honda R&D Europe asked a question what sustainable mobility means? Concentration on CO2 exhaustion and emissions is just one of the aspects. Sustainable mobility should have zero environmental impact “we call it triple 0 – first 0 for C02 and emission, the second 0 is energy risk and last but not least the third 0 stands for resources and disposal”- said Michael Fischer. Carbon neutral hydrogen production and carbon-neutral fuels in specific application are very important topics. Moreover, “in Honda we call it a multi-pathway – we have the right product in the right place for the right application by providing the right energy carrier”.

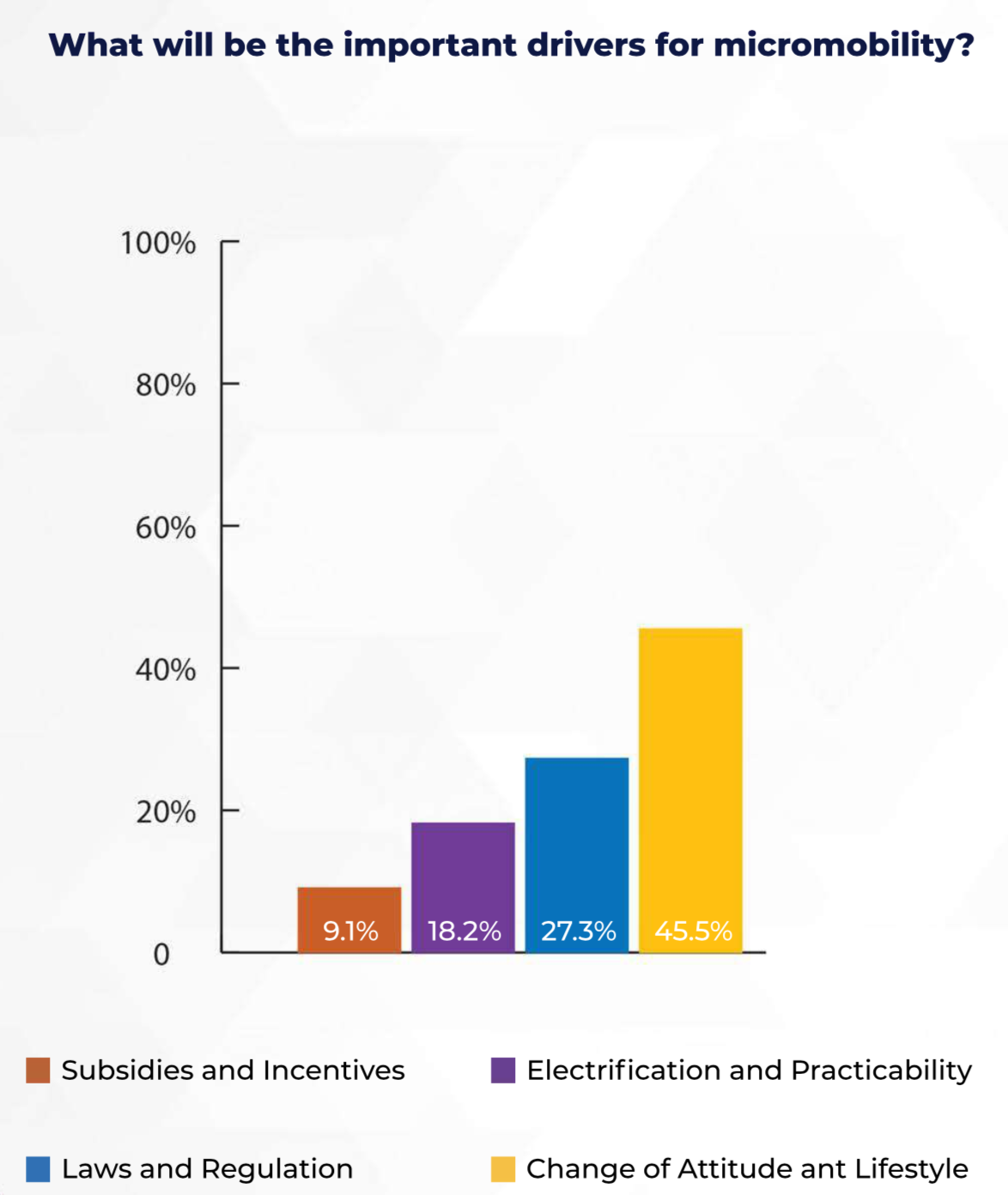

Last speaker, Wim Ouboter, Founder of Microlino, a full range company addressing micro-mobility. He discusses an issue concerning L7e – category between a motorbike and a car. “They think, well this is not a car, so when they subsidize electric cars, they forget about the L7e vehicles”. In addition, he said that Microlino is amazing for sharing: Students, for example, can use an app to see who and on which day someone uses it as well as for short-distance travelling. Also, Wim Ouboter and Hans-Peter Kleebinder were discussing the need for a new mindset and a movement for micro-mobility as a counter-movement to the “SUV-PAndemic”. Hans-Peter Kleebinder pointed out the narrative for this approach: “The amount of resources needed to get us from A to B has increased significantly over the last 25 years. Between the VW Golf of 1995 and the current VW Golf, its area has increased by 12% and its weight by 25%. The average HP of new passenger cars has grown by 66% during the same period.” Furthermore, replaceable batteries and carbon-neutral hydrogen production and carbon-neutral fuels in specific applications were by Hans-Peter Kleebinder.

Final question to the panel: What will sustainable mobility in the year 2025 look like?

Lukas Neckermann:

„We use the default car, as a result we have built our infrastructure, financial environment around it – “I wish that we would break out of this automated notion that we have to have a car for all our transport and we would rely on a DIFFERENT modes of mobility”

Michael Fischer:

„2025 is tomorrow, so on one side I am afraid it won’t be too much different from today, but I can answer 2025 with one word – DIVERSE”

Wim Ouboter:

“It will be SMALL, PORTABLE AND ELECTRIC“

Conclusion of the second panel:

Vielleicht da noch 1 order 2 Sätze von dir zum Abschluss?

#coronarampup #reboot #EV #smartmobility #Europe #micromobility #sustainablemobility

Author: Dr. oec. Hans-Peter Kleebinder